Travis Kelce’s Latest Play? Investing in Six Flags Stock

Move over, touchdowns—Travis Kelce’s newest win might be on Wall Street. The Kansas City Chiefs star..

Read moreOwn a Piece of the Toronto Blue Jays as They Head to the 2025 World Series

The Toronto Blue Jays are officially headed to the 2025 World Series, marking their first appearance..

Read moreWhat is a Voter Proxy? Participating in Company Decisions as a Shareholder

Owning stock isn’t just about price charts and dividends. It also gives you a real say in how a comp..

Read moreUnique Holiday Gift Idea: Give the Gift of Stock

The holidays are the season of giving—but let’s face it, finding a gift that’s meaningful, unique an..

Read moreWhat is a DRIP? How Dividend Reinvestment Plans Work

If you’re new to investing, the word “DRIP” might sound more like something related to coffee than f..

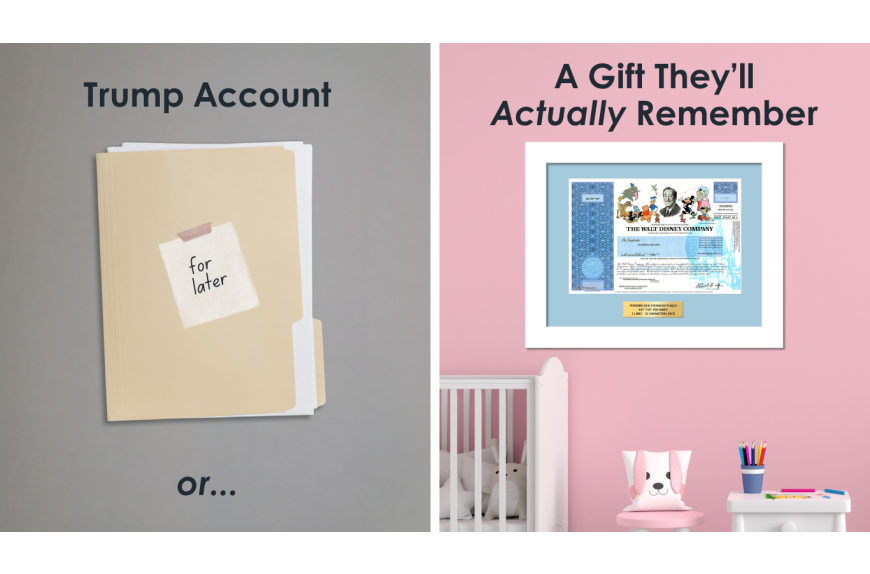

Read moreHow to Turn Your Baby’s $1,000 Trump Account Into a Meaningful Gift

Starting in 2025, every newborn in the U.S. will automatically receive a $1,000 government-funded in..

Read moreNew Partnership with KidVestors Lets Kids and Teens Experience Stock Ownership—One Share at a Time

We’re excited to announce a powerful new partnership that brings real investing opportunities d..

Read moreFather’s Day Gifts for Dad: Unique Ideas for the Man Who Has Everything

Tired of the same old grill tools and golf balls? This year, give Dad something he won’t expect—a fr..

Read moreWhat is a Transfer Agent? Behind the Scenes of Stock Ownership

When you buy a share of stock, there’s more happening behind the scenes than you might think. Enter ..

Read moreCelebrate Mom with a Share in Her Favorite Brand: Unique Mother’s Day Gift Ideas

Flowers wilt. Candles burn out. But giving Mom a share of stock in her favorite brand? That’s a Moth..

Read more