The Demise of Paper Stock Certificates

Paper stock certificates are on their way to becoming extinct.

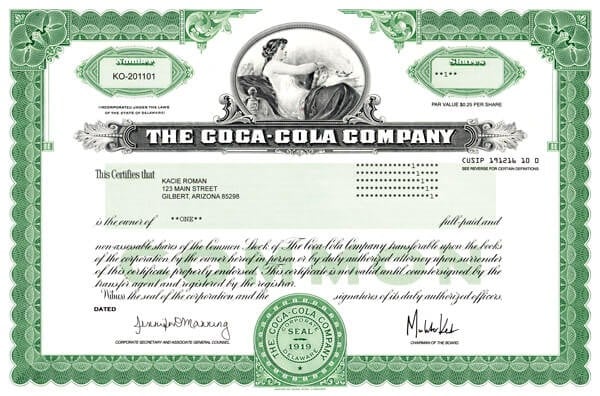

Only At GiveAshare

Stock brokers stopped issuing stock certificates (or imposed huge fees) years ago. Now, GiveAshare is the ONLY place to easily and affordably get authentic paper stock certificates. Over half of the companies on our list still offer registered stock certificates so get one while you still can.

For the companies that only register ownership electronically, we have attractive replicas that we personalize. They look like the real thing.

Collectible Value

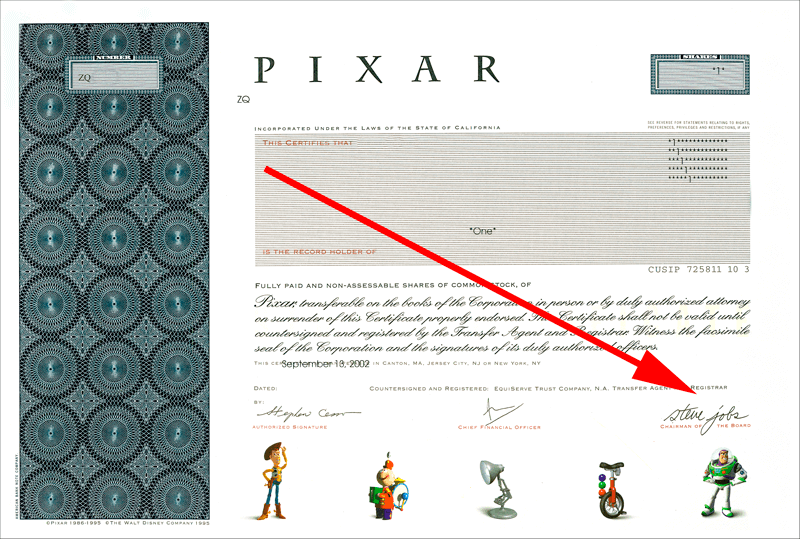

To save money, the securities industry is moving toward electronic registration instead of issuing paper stock certificates. Along with normal corporate actions like mergers, this effort is making physical stock certificates increasingly rare raising collectible value (see below). For example, a Pixar certificate with Steve Jobs printed signature sells for more than $500 on collectible websites (see right).

Latest Certificates To Bite the Dust

Tiffany

Acquired by LVMH in Jan 2021

You can still buy LVMH stock

Dunkin Brands

Acquired by Inspire Brands Dec 2020

Craft Brew

Acquired by Anheuser-Busch Sep 2020

WebMD

Taken private Sep 2017

Petsmart

Went private in 2015

Orbital Sciences

Merged with ATK in 2015

1-800-Flowers

Went paperless in 2014

Dell

Went private in 2013 then came back paperless later

GameStop

Went paperless 2013, then paper in 2020, then paperless again in 2020

You can still buy Gamestop stock

SeaWorld

Issued about 10 certs after IPO then went paperless. Go figure?

You can still buy SeaWorld stock

Steinway

Taken private in 2013

Human Genome Sciences

Acquired by Glaxo in 2012

Playboy Enterprises

Hefner took the company private in March 2011

You can still buy Playboy collectible stock

General Motor New

Emerged from bankruptcy - paperless 2010

Motorola

Split into two companies, both paperless in 2012

Apple

Apple went paperless 2010. Congratulations to all our past customers who got a real one!

You can still buy Apple stock

Burger King

Went private in 2010

Palm Inc.

Acquired by HP in 2010

World Poker Tour

Assets acquired by PartyGaming in 2009

Marvel

Acquired by Disney in 2009

Wyeth

Acquired by Pfizer in 2009

Visa Intl Inc.

Went paperless in 2009

Wm Wrigley Company

Acquired by Mars Inc., a private company

Merrill Lynch

Acquired by Bank of America in 2008

ImClone Systems

Acquired by Eli Lilly in 2008

Pixar Animation

Acquired by Disney in 2007. These collectible certificates sell for over $500 on collectible sites!

Elimination of Paper Stock Certificates - Chronology

Like everything else, stock ownership is going digital! The securities industry calls it "dematerialization" - we call it sad. Brokers no longer provide stock certificates (or charge a huge disincentive fee) and a growing list of companies like Disney have stopped issuing paper. The industry-wide effort started over 30 years ago but momentum is building:

Like everything else, stock ownership is going digital! The securities industry calls it "dematerialization" - we call it sad. Brokers no longer provide stock certificates (or charge a huge disincentive fee) and a growing list of companies like Disney have stopped issuing paper. The industry-wide effort started over 30 years ago but momentum is building:

2020 - DTC white paper calls for elimination for all stocks certificates within a couple of years after Covid stresses the system. Industry-wide work group established to make it happen.

2018-19 - The pace of companies eliminating paper certificates quickens.

2015 - Computershare, the largest transfer agent in the U.S., announces it will charge a $25 disincentive fee to issue paper stock certificates.

2009-12 - The Depository Trust Company (DTC) starts charging stock brokers a $500 fee to issue stock certificates to customers. Brokers pass on the $500 fee to customers.

2008 - 1/1/2008 was the target date established for all companies on the NASDAQ and NYSE to be set up on the DRS. Although the target gets moved out, most companies comply.

2007 - As of 1/1/2007, any new issue on NASDAQ or NYSE had to be eligible for electronic registration on the Direct Registration System (DRS).

1970's - Brokerage firms took the first step to streamline paperwork by establishing a central depository, the Depository Trust Company (DTC) where all stock certificates could be maintained.

2006 - Delaware, the state where many companies are incorporated, changed its state law removing the requirement for physical stock certificates. This got the ball rolling.

1960's - Financial district messengers carried satchels of stock certificates from one broker to another. During peak periods, the stock market would be closed one day a week to allow brokerage firms to catch up on paperwork.