If you’ve ever looked into investing, you may have heard the term dividend. But what exactly is a dividend, and why does it matter to stockholders?

At its core, a dividend is a portion of a company's profits that it pays out to its shareholders. Not all stocks pay dividends, but those that do can provide investors with a steady stream of income in addition to potential stock price appreciation. Let’s break it down further.

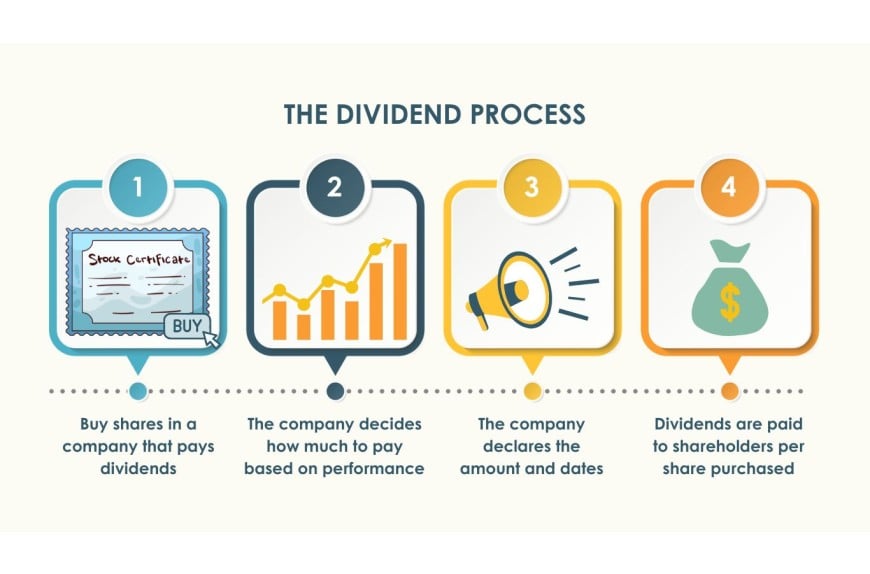

How Do Dividends Work?

When a company earns a profit, it has a few choices:

- Reinvest it in the business to fund growth, research, or acquisitions.

- Save it for future needs.

- Return a portion to shareholders in the form of dividends.

If a company decides to distribute dividends, it typically does so on a regular schedule, such as quarterly (every three months), although some companies pay monthly or annually. For example, if you own one share of a company that pays a $1 dividend per share per quarter, you’ll receive $1 every three months, or $4 over the course of the year. If you own 10 shares, you’d receive $10 per quarter, or $40 per year.

Key Dividend Terms to Know

- Dividend Yield – A percentage that represents how much a company pays in dividends relative to its stock price. If a stock trades at $100 and pays a $4 annual dividend, its dividend yield is 4%.

- Ex-Dividend Date – The date on which new buyers of the stock will not receive the next dividend.

- Dividend Payout Ratio – The portion of a company’s earnings paid out as dividends.

- Dividend Reinvestment Plan (DRIP) – A program that automatically reinvests dividends into additional shares of stock instead of paying out cash. This allows investors to compound their investment over time without having to manually buy more shares.

Why Are Dividends Appealing to Investors?

Dividends can be an attractive feature of stock ownership for several reasons:

- Passive Income – Investors receive cash payments without selling shares, making it a great way to generate steady income over time.

- Compounding Growth with DRIPs – If you reinvest dividends through a Dividend Reinvestment Plan (DRIP), you can automatically buy more shares, leading to exponential growth over time. This is a popular strategy for long-term investors looking to maximize their returns.

- Stability – Many blue-chip companies (large, well-established businesses) pay dividends consistently, making them attractive to long-term investors.

- Total Return Boost – Even if a stock’s price doesn’t rise significantly, dividends can still provide positive returns.

Stocks with DRIPs at GiveAshare

At GiveAshare.com, we make stock ownership simple and accessible by offering the ability to gift a real share of stock in some of the most well-known companies. Many of these stocks offer DRIPs, allowing shareholders to automatically reinvest dividends to purchase more shares over time—without having to make additional investments!

See our full list of stocks with DRIPs here.

This is an excellent option for those who want to grow their investment passively while holding a tangible piece of ownership in a company they love. Even if a stock doesn’t pay dividends, ownership can still be rewarding through long-term capital appreciation and a sense of company loyalty.

Want to Learn More?

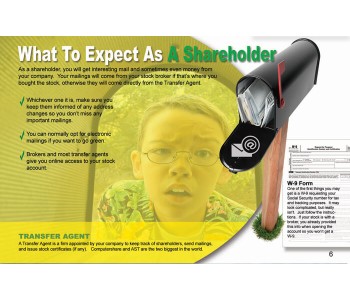

If you’re new to investing, gifting a share of stock can be a fun and educational way to introduce financial literacy to kids and beginners. Pairing a stock gift with the I’m A Shareholder Book is a great way to help new shareholders understand dividends, DRIPs, and investing basics.

For those who already hold shares in a brokerage account, we also offer Personalized Replica Stock Certificates—a perfect keepsake for displaying your investment in a tangible way!

Final Thoughts

Dividends can make stock ownership even more appealing by providing passive income and contributing to long-term growth. If you’re looking for a way to build wealth, stocks with DRIPs can be a great option to grow your portfolio over time. Ready to start your journey as a shareholder? Explore our selection of stocks and give the gift of ownership today!

Tags:DividendsDividend StocksStock InvestingFinancial LiteracyInvesting For BeginnersPassive IncomeDRIPStock MarketLong Term InvestingGiveAshare

Write a comment